Cash, No- Cash, Some-Cash, Whatever! Scan Karo and Payment Bharo. It is that Simple.

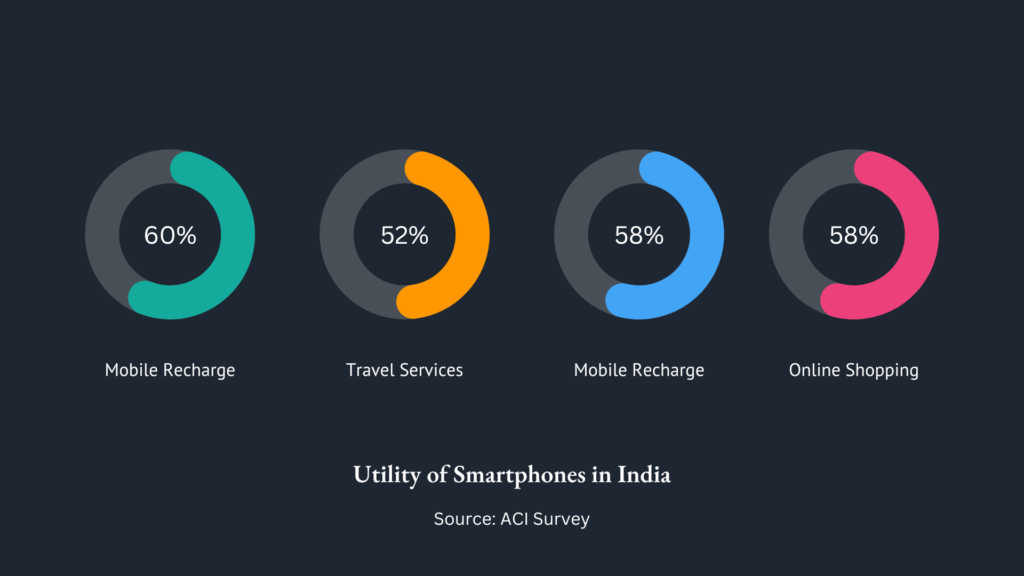

Open the App, scan the QR Code, put the pin, and shop anywhere you want. Today, life is easier with Digital Payment Applications.

From every Kirana shop to street food vendors to paying electricity bills to those COD transactions paying bills was never easier, where all you had to do was scan the QR and pay your bills at your doorstep. In fact, On 1st November 2018, ‘UPI as a payment option in IPO’ was introduced as a new payment channel to the retail investors by SEBI.

And with the onset of the Pandemic made few good things happen. First, India shifted to contactless payment, and also, the ones who never understood UPI-based transactions now totally understand how to make UPI-based transactions.

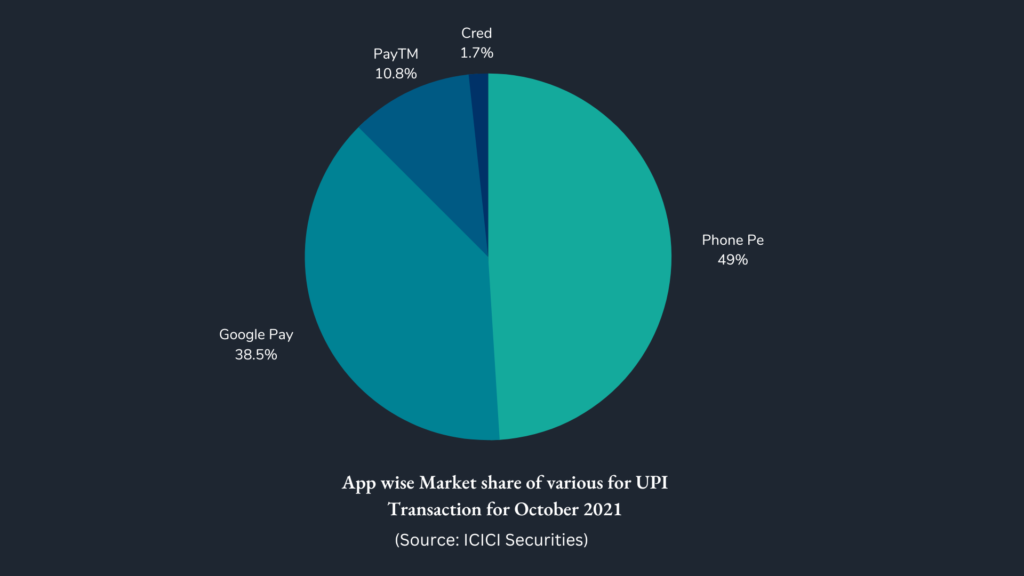

There are very few foreign players, namely WhatsApp and Goggle Pay, and many domestic companies like Paytm, Phone Pay, Dhani, BHIM Axis Pay, Mobikwik, etc. According to ICICI Securities in October, PhonePe led the UPI numbers with 193 crore transactions. Goggle Pay came second with 145 crore transactions worth 2.87 lakh crore.

The Economic Survey of India 2021-22 says that in December 2021, 4.6 billion transactions worth `8.26 lakh crore were UPI-based transactions. As per detailed transaction data of NPCI, 50 percent of transactions through UPI were below `200. Further, RBI has increased the transaction limit to `5 lakh in December 2021. (Source: Economic Survey Complete PDF.pdf)

Recently, RBI has launched UPI123Pay, which allow feature phone users to make payment through UPI without the internet.

Now you can even make UPI-based transactions in both Singapore and Bhutan. RBI and the Monetary Authority of Singapore have announced to link UPI and PayNow, targeted for operation in July 2022. And Bhutan recently became the first country to adopt UPI standards for its QR code. It is also the second country after Singapore to accept BHIM-UPI at merchant locations.(Source: Economic Survey Complete PDF.pdf)

Is Cashless Economy Good or Bad?

1. Digital Literacy is still Low in some places

Going cashless is fine, but many don’t know how to use mobile phones. For them, making UPI-based transactions can be difficult. But that doesn’t mean they cannot.

Because there was a time when millennials only used WhatsApp or any internet chat box, now the whole ecosystem walks and talks over the internet these days, which means undoubtedly, the volume of users will further increase in the future.

2. Cybercrime is For Real

I am sure many win 2 million Lottery every day.

India is among the top 3 most affected countries affected by Ransomware attacks. In Ransome attacks, cybercriminals often steal data and demand some payment in return by getting access to network systems and data. Last year, 49 percent of companies in India suffered multiple ransomware attacks in India.

3. Not Everybody has Bank Accounts in India.

Though India has consistently creatively worked on increasing the bank accounts of individuals, still many don’t have bank accounts and don’t even understand its operations.

Final Thoughts

India is currently not ready to go for an entirely cashless economy. But yes, the digital payment system has indeed made life easier. It saves time and serves many needs of Individuals.

Subscribe to new post

The One Liner

Useful Links

Order Related Queries

Useful Links

Order Related Queries